Basic Equity Value vs Diluted Equity Value. Basic equity value is simply calculated by multiplying a company’s share price by the number of basic shares outstanding. A company’s basic shares outstanding can be found on the first page of its 10K report. The calculation of basic shares outstanding does not include the effect of dilution that may occur due to dilutive securities such as stock options, 15/11/ · Because your purchase price stays the same, if the value of the stock goes up, you could make money on the difference. We’ll elaborate on this in part 2 of our equity series. There are two types of employee stock options: incentive stock options (ISOs) and non-qualified stock options (NSOs). These mainly differ by how and when they’re taxed—ISOs could qualify for special tax 1. Employee Stock Option Basics To frame the discussion of options and equity valuation, it is useful to consider typical features of employee stock options and a basic approach for incorpo-rating options in valuation. In this chapter, I develop a simple option example to highlight the economic implications of options for existing equityholders

Equity vs Stock Option -

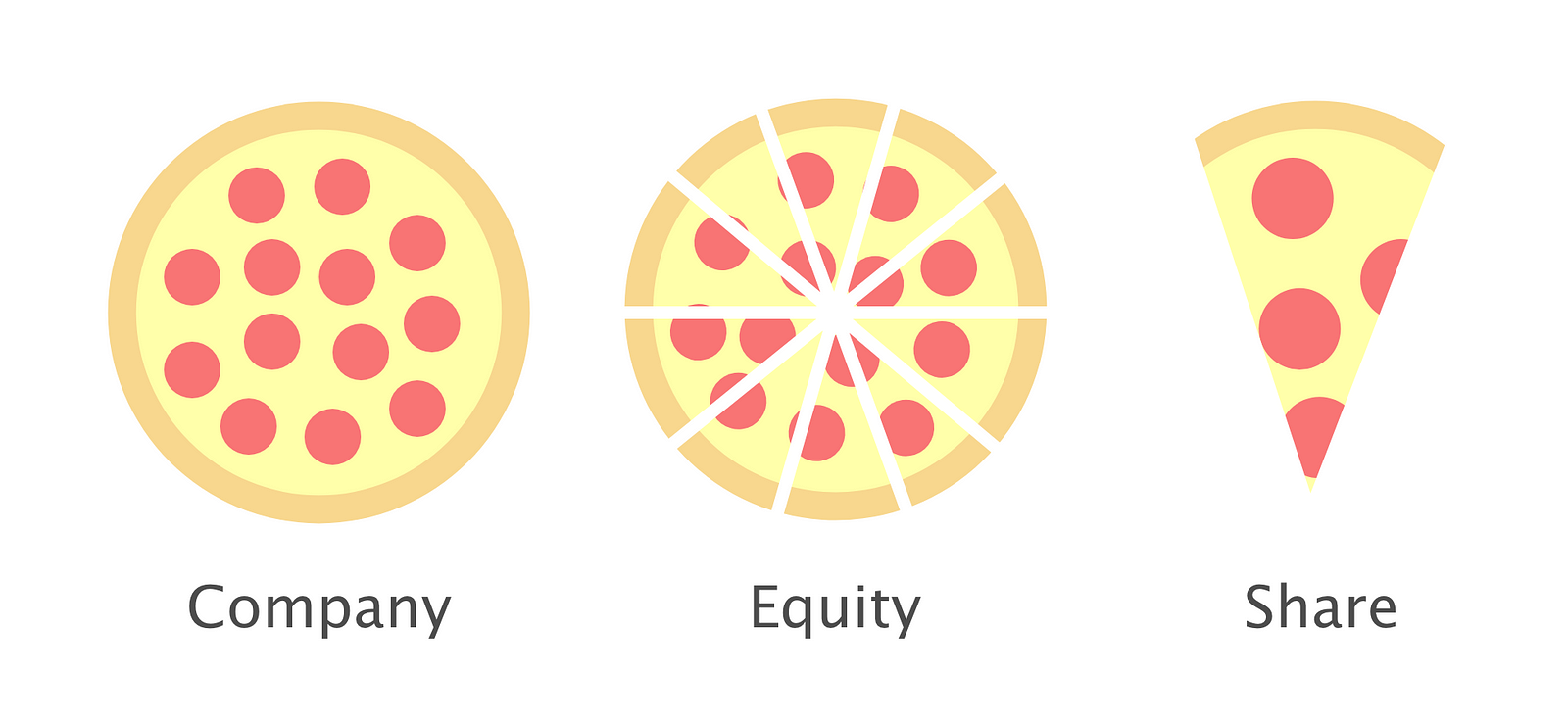

Equity value stock options term Equity can mean stock or shares. It is often used to refer to stock options as well. Stock options give you the right to buy a certain number of shares at a certain price after a certain amount of time. They do not represent ownership unless your right to buy them has vested. Equity investment means ownership in a company.

You buy equity when the stocks trade at a certain valuation, hoping the valuation will increase and your ownership position will become more valuable. A Share of stock represents a small ownership piece of business. Most publicly traded businesses are organized as corporations, which issues a certain number of shares of common stock, equity value stock options, with each share representing an equal ownership percentage, or equal equity percentage.

If you buy shares of common stocks, you participate in both profits and losses of that corporation, you get to vote at the annual meeting.

But you are also not held personally liable for anything equity value stock options that happens at the company. That what happens when you own an equity position.

When you purchase stock, you are purchasing equity in a company from someone who wants to sell it. when you sell stock that means you selling that equity to another buyer. Stock is a tradable form of equity. The reason tradable equity was invented because different people believe different things about the present and future value of a given company.

Stock allows them to trade with each other based upon those different opinions and goals. The price at which the employes can purchase shares is known as the exercise price, equity value stock options.

A stock option gives an investor the right but not the obligation, to buy or sell a stock at an agreed-upon price and date. There are two types of options puts and calls. Puts is a bet that a stock will fall and calls is a bet that a stock will rise. Equity value stock options contract represents shares of the underlying stock.

Equities are ownership positions in an asset, usually a company. Over time, you build equity by paying off the loan principal and get ownership. In the stock market, the more stock you buy, the more ownership you have in the company. Equity is a bit trickier. Equity value stock options, at its basic level, is an ownership share in a company.

Shares are issued in a series and are typically either labeled as common or preferred. Employees are typically granted common stock. Which is different from preferred stock in that it carries no preferences, which are add-on perks that accompany the shares. There are no hard and fast rules for how large or small an option pool maybe, But there are some common numbers.

Although there are a variety of ways to get equity as a startup employee the most common way is through stock options. A stock option is the guarantee of an employee to be able to purchase a set amount of stock at a set price regardless of future increases in value. Exercising stock options is a fairly common transaction, but there are some additional rules among startups that could present problems. These stock units are generally awarded directly to the employee with no purchase required.

When you are granted equity by a startup, it may be taxable. The type of equity you receive, and whether or not you paid for it plays into the question. For example, a stock option granted to an employee with a strike price equal to fair market value is not taxable to the employee. However, a grant of the actual stock is taxable to the employee if the employee does not purchase equity value stock options from the company. Standard stock options are known as incentives stock options ISOs by the IRS.

ISO does not create a taxable event until they are sold. Determining the true dollar value of your equity is very difficult. Usually, there is a range and it is dependent on the exit opportunities the company is pursuing. The concept of value is further complicated by the potential legal and HR issues that arise around the conversation of equity value that founders could have with their employees. Most counsel will advise a founder to be very careful about having that conversation.

Because equity compensation packages are different for each company at each individual stage, it can be challenging to vet the deal. But there are some red flags you can look out for. Another red flag could be how much equity you are being offered. If you are a very early employee and the opening offer is five basis points 0. Or, if the exercisability of grants differs wildly from employee to employee, equity value stock options.

Adobe Creative Suite CS is the go-to product for creatives in a multitude of industries, like design, marketing, and media. With over 20 desktop and. There are people around the world who love to play games while there are others who prefer to build games. Home Contact Us Blog Apply As Coder Hire A Coder Menu. Equity vs Stock Option.

Adam Davidson September 2, Share This Post, equity value stock options. Share on facebook. Share on linkedin. Share on twitter. Share on email, equity value stock options. Subscribe To Our Newsletter.

Get updates and learn from the best. Next Google Docs VS Microsoft Office, equity value stock options. More To Explore. Augmenting Adobe Creative Equity value stock options Capabilities with Custom Plugins and Extensions Adobe Creative Suite CS is the go-to product for creatives in a multitude of industries, like design, marketing, and media.

William Dawson September 4, Lucas White August 24, Want To Hire Top Remote Developers? Drop Us A Quick Message. Contact Us. Guest Post. Copyright © Codersera Inc. All rights reserved.

Restricted Stock vs. Stock Options (Everything You Need to Know)

, time: 9:29How To Understand Stock Options In Your Job Offer | blogger.com

15/11/ · Because your purchase price stays the same, if the value of the stock goes up, you could make money on the difference. We’ll elaborate on this in part 2 of our equity series. There are two types of employee stock options: incentive stock options (ISOs) and non-qualified stock options (NSOs). These mainly differ by how and when they’re taxed—ISOs could qualify for special tax 1. Employee Stock Option Basics To frame the discussion of options and equity valuation, it is useful to consider typical features of employee stock options and a basic approach for incorpo-rating options in valuation. In this chapter, I develop a simple option example to highlight the economic implications of options for existing equityholders Basic Equity Value vs Diluted Equity Value. Basic equity value is simply calculated by multiplying a company’s share price by the number of basic shares outstanding. A company’s basic shares outstanding can be found on the first page of its 10K report. The calculation of basic shares outstanding does not include the effect of dilution that may occur due to dilutive securities such as stock options,

No comments:

Post a Comment