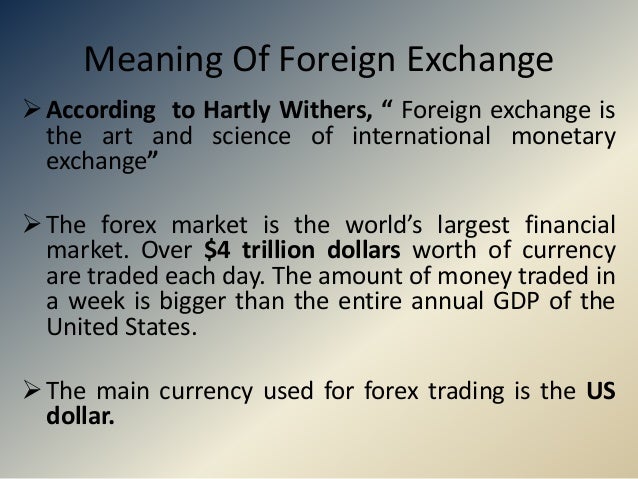

Foreign currency trading is conducted without a central exchange, but instead is traded over-the-counter (OTC). Unlike other markets, this decentralization allows traders to choose from a large number of different dealers or brokers with which to place trades. This also provides the means to compare prices and pip spreads before buying or blogger.com by: 2 25/04/ · The foreign currency market functions 24 hours a day for days a week, opening on Sunday afternoon and closing on Friday, along with the New York market. As it is a fundamentally unorganized market, the forex market has a large number of operations centers around the blogger.comted Reading Time: 5 mins the CURRENCYof an overseas country that is purchased by a particular country in exchange for its own currency. This foreign currency is then used to finance INTERNATIONAL TRADEand FOREIGN INVESTMENTbetween the two countries. See FOREIGN EXCHANGE

The foreign currency market: What it is and how it works | BBVA

Kimberly Amadeo is an expert on U. and world economies and investing, with over 20 years of experience in economic analysis and business strategy. She is the President of foreign currency market definition economic website World Money Watch. As a writer for The Balance, Kimberly provides insight on the state of the present-day economy, as well as past events that have had a lasting impact. Eric is a duly licensed Independent Insurance Broker licensed in Life, Health, Property, and Casualty insurance.

He has worked more than 13 years in both public and private accounting jobs and more than four years licensed as an insurance producer. His background in tax accounting has served as a solid base supporting his current book of business. The foreign exchange market is a global online network where traders buy and sell currencies. It has no physical location and operates 24 hours a day from 5 p. EST on Sunday until 4 p.

EST on Friday because currencies are in high demand. It sets the exchange rates for currencies with floating rates. It is the largest and most liquid financial market in the world. This global market has two tiers. The first is the interbank market. It's where the biggest banks exchange currencies with each other.

Even though it only has a few members, the trades are enormous. As a result, it dictates currency values. The second tier is the over-the-counter market. That's where companies and individuals trade.

OTC has become very popular since there are now many companies that offer online trading platforms. New traders, starting with limited capital, need to know more about forex trading. The biggest geographic OTC trading center is in the United Kingdom, foreign currency market definition. London dominates the market. As of AprilU. This makes London the most important forex trading center in the world.

Foreign exchange trading is a contract between two parties. There are three types of trades. The spot market is for the currency price at the time of the trade. The forward market is an agreement to exchange currencies at an agreed-upon price on a future date.

A swap trade involves both. Dealers buy a currency at today's price on the spot market and sell the same amount in the forward market. This way, they have just limited their risk in the future. No matter how much the currency falls, they will not lose more than the forward price.

Meanwhile, they can invest the currency they bought on the spot market. The interbank market is a network of banks that trade currencies with each other. Each has a currency trading desk called a dealing desk. They are in contact with each other continuously. That process makes sure exchange rates are uniform around the world. The minimum trade is 1 million of the currency being traded.

Most trades are much larger, between 10 million and million in value. As a result, exchange rates are dictated by the interbank market, foreign currency market definition. The interbank market includes the three trades mentioned above. Banks also engage in the SWIFT market. It allows them to transfer foreign exchange to each other. SWIFT stands for Society for World-Wide Interbank Financial Telecommunications.

Banks trade to create profit for themselves and their clients. When they trade for themselves, it's called proprietary trading. Their customers include governments, sovereign wealth funds, large corporations, hedge funds, foreign currency market definition, and wealthy individuals.

Here are the 10 biggest players in the foreign exchange market, according to Euromoney's FX Survey:. The Chicago Mercantile Exchange was the first to offer currency trading. It launched the International Monetary Market in Other trading platforms include OANDA, Forex Capital Markets LLC, and Forex, foreign currency market definition.

The retail market has more traders than the Interbank Market. But the total dollar amount traded is less. The retail market doesn't influence exchange rates as much.

Central banks don't regularly trade currencies in foreign exchange markets. But they have a significant influence. Central banks hold billions in foreign exchange reserves. Japanese companies receive dollars in payment for exports.

They exchange them for yen to pay their workers. Japan, like other central banks, could trade yen for dollars in the forex foreign currency market definition when it wants the value to fall.

That makes Japanese exports cheaper. Japan prefers to use methods that are more indirect though, such as raising or lowering interest rates to affect the yen's value. For example, foreign currency market definition, inthe Federal Reserve announced it would raise interest rates in InCitigroup, Barclays, foreign currency market definition, Foreign currency market definition Chase, and The Royal Bank of Scotland pled guilty to illegal manipulation of currency prices.

Here's how they did it. Traders at the banks would collaborate in online chat rooms. One trader would agree to build a foreign currency market definition position in a currency, then unload it at 4 p. London Time each day. That price is based on all the trades taking place in one minute. By selling a currency during that minute, the trader could lower the fix price. That's the price used to calculate benchmarks in mutual funds. Traders at the other banks would also profit because they knew what the fix price would be.

These traders also lied to their clients about currency prices. For the past years, there has been some form of a foreign exchange market. For most of U. history, the only currency traders were multinational corporations that did business in many countries.

They used forex markets to hedge their exposure to overseas currencies. They could do so because the U. dollar was fixed to the price of gold.

The foreign exchange market didn't take off until That's when President Nixon completely untied the value of the dollar to the price of an ounce of gold. The history of the gold standard explains why gold was chosen to back up the dollar. Once Nixon abolished the gold standard, the dollar's value quickly plummeted. The dollar index was established to give companies the ability to hedge this risk.

Someone created the U. Dollar Foreign currency market definition to give them a tradeable platform. Soon, banks, hedge funds, and some speculative traders entered the foreign currency market definition. They were more interested in chasing profit than in hedging risks. The Forex market buys and sells currencies. It operates on two levels: interbank and over-the-counter.

The interbank market trades in enormous volumes. So, they dictate foreign exchange rates. The largest OTC center is in London. Since U. trading forms almost half of the global forex trading bulk, foreign currency market definition, the United Kingdom holds the most dominant and influential forex trading center in the world.

These banks hold several billion in foreign exchange reserves. Ina group of banks colluded to illegally manipulate currencies.

Forex Trading for Beginners

, time: 8:39Foreign Exchange Market Definition

27/06/ · The currency market, or foreign exchange market ("forex"), was created to facilitate the exchange of currency that is necessary as the result of foreign trade. 25/04/ · The foreign currency market functions 24 hours a day for days a week, opening on Sunday afternoon and closing on Friday, along with the New York market. As it is a fundamentally unorganized market, the forex market has a large number of operations centers around the blogger.comted Reading Time: 5 mins the CURRENCYof an overseas country that is purchased by a particular country in exchange for its own currency. This foreign currency is then used to finance INTERNATIONAL TRADEand FOREIGN INVESTMENTbetween the two countries. See FOREIGN EXCHANGE

No comments:

Post a Comment