23/02/ · How to Calculate Free Margin. Here’s how to calculate Free Margin: Free Margin = Equity - Used Margin. If you have open positions, and they are currently profitable, your Equity will increase, which means that you will have more Free Margin as well. Floating profits increase Equity, which increases Free Margin The Forex Margin Calculator can also be used to find the least "expensive" pairs to trade. For the same example above, and by using the same calculating parameters ( leverage and a lot trading position), if instead of selecting the EUR/USD we choose the AUD/USD, then we see that the margin required would be much less, only GBP Margin and margin requirements are something that no forex trader can afford to ignore. Margin has often been labeled a “good faith deposit” to open a position. Margin is usually presented as a percentage amount of the full position, %, %, 1%, 2%, and so on

Leverage Calculator | Forex Margin Calculator

The margin requirement for your open trades forex free margin calculation the Forex market may seem confusing at first but it is essential to memorize the formula as it may serve you from falling into the horrendous margin call trap.

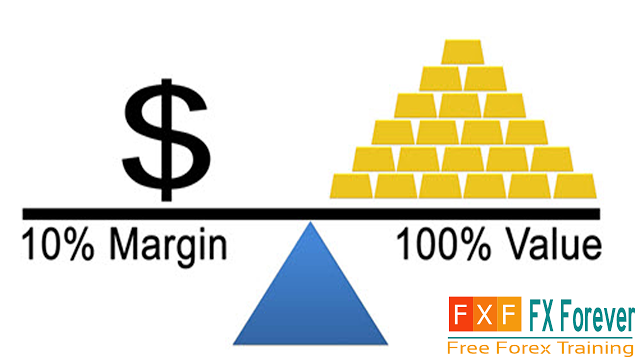

To simplify, the margin requirement is a certain portion of your account balance that is set aside to sustain your open trades in the market and is not a commission charged by your broker. Once you close your trades that funds that were allocated to sustain the open positions will return to forex free margin calculation account balance. We will begin with currency pairs that the US Dollar USD is the secondary currency such as EURUSD, AUDUSD, NZDUSD and GBPUSD. Before calculating the margin requirement it is important to make a note of the leverage that is provided by the forex broker.

It may be as small as or as high as in our example, forex free margin calculation, we will take a leverage, which is supplied by most brokers for forex trading. But, as the broker provides the ability to leverage, the required margin is reduced dramatically, forex free margin calculation.

To summarize, executing a 1, units trade in EURUSD at 1. The above calculation is applicable also for GBPUSD, AUDUSD and NZDUSD as we have stated earlier.

In USDCAD, USDCHF and USDJPY the US Dollar acts as the base currency. In order to determine the margin requirement for those currency pairs the following calculation is made:. Unlike EURUSD, forex free margin calculation, we do not need USDCAD price in order to calculate the margin requirement, the trade size of the leverage are sufficient.

The same calculation is applicable for USDCHF and USDJPY. In this example we will show you how to calculate the margin when the US Dollar is not present in the base and secondary currency such as GBPJPY, EURGBP, NZDJPY etc. You may be surprised but the margin requirement will be determined by the base currency against the US Dollar regardless of the cross you wish trade.

To simplify, to calculate the margin requirement for GBPJPY we would use GBPUSD. To calculate the margin requirement for EURGBP we would use EURUSD. Margin requirement: As GBP is the base currency in GBPJPY, the margin requirement will be calculated using GBPUSD price.

In fact, this will be the margin requirement for all currency pairs where GBP acts as the base currency such as GBPCHF and GBPNZD. We have focused on the minimal trade size that is accepted by most brokers. If you are trading in the MetaTrader4 MT4 we strongly recommend you to memorize the value of lots in units as we specified in our forex trading guide. To conclude forex free margin calculation margin requirement, the bigger the leverage the broker is providing you the smaller the margin requirement would be regardless of the amount of leverage you chose to exercise.

In many trading platforms you will see the following once you place trades in the market, Balance, Equity, Free Margin and Margin Level. The balance would be the total amount forex free margin calculation capital you have in your trading account excluding open trades.

The equity is the total amount of capital you have in your balance including open trades. The margin level is often displayed in percentage points. It is calculated by dividing the equity by the used margin and then multiplying it by The margin requirement for a trade of 20, units or 0. As you may see you have plenty of margin available.

It will often occur if you decide to over-leverage your positions, which would boost the margin requirements for your trades.

When that occurs you will be able to close your trades but lack the ability to place new trades due to lack of free margin. If the market continues to trade against you, forex free margin calculation, once the stop out level is reached all your positions will be instantly closed and a significant loss is likely to be incurred. The stop out level is predetermined by you broker, it may be as small as 5.

Regardless of whether you are considering to over-leverage or not it is essential to understand the trading conditions that are presented to you by the broker, forex free margin calculation. You know understand what is the margin requirement, how to calculate the margin requirement, free margin, forex free margin calculation, margin call and the stop out level as a result of insufficient margin.

LEARN MORE. Facebook Twitter LinkedIn. We provide market research and trade alerts to online traders across the globe LEARN MORE. TRADE ALERTS FX INTRADAY. Everything About the Forex Margin was last modified: July 12th, by Digital Derivatives Markets. Open toolbar. Accessibility Tools Increase Text Decrease Text Grayscale High Contrast Forex free margin calculation Contrast Light Background Links Underline Readable Font Reset.

Here's why you'll NEVER make money in Forex. The Forex Cycle of Doom...

, time: 7:18Calculating the Margin Requirements | DDMARKETS

The Forex Margin Calculator can also be used to find the least "expensive" pairs to trade. For the same example above, and by using the same calculating parameters ( leverage and a lot trading position), if instead of selecting the EUR/USD we choose the AUD/USD, then we see that the margin required would be much less, only GBP Margin and margin requirements are something that no forex trader can afford to ignore. Margin has often been labeled a “good faith deposit” to open a position. Margin is usually presented as a percentage amount of the full position, %, %, 1%, 2%, and so on 23/02/ · How to Calculate Free Margin. Here’s how to calculate Free Margin: Free Margin = Equity - Used Margin. If you have open positions, and they are currently profitable, your Equity will increase, which means that you will have more Free Margin as well. Floating profits increase Equity, which increases Free Margin

No comments:

Post a Comment