12/05/ · Hedging is a method of reducing risk in trading by opening one or more positions that will balance an existing trade. While hedging doesn’t 22/09/ · A forex hedging robot is designed around the idea of hedging, which is based on opening many additional positions and buying and selling at the same time combined with trend analysis. This is all done in order to protect yourself against sudden and unexpected market blogger.comted Reading Time: 8 mins What is forex hedging? Hedge is a kind of insurance. Forex hedging currency risks is actions meant to lessen risks related to volatility of foreign exchange rates. When traders decide to hedge, they decide to protect themselves from possible losses. However, it is difficult to grab the principle of forex hedging from a simple definition

How to Hedge Forex Positions | Forex Hedging Strategies | IG EN

Want to know what is hedging in Forex? This article will provide you with everything you need to what is forex hedging about hedging, give you an example of a Forex hedging strategy, an explanation of the 'Hold Forex Strategy' and more! Hedging means taking a position in order to offset the risk of future price fluctuations. It is a very common type of financial transaction that companies conduct on a regular basis, as a regular part of conducting business. Companies often gain unwanted exposure to the value of foreign currencies, and the price of raw materials.

As a result, they seek to reduce or remove the risks that come with these exposures by making financial transactions. In fact, financial markets were largely created for just these kind of transactions - where one party offloads risk to another. For instance, an airline might be exposed to the cost of jet fuel, which in turn correlates with the price of crude oil, what is forex hedging.

A US multinational will accrue revenue in many different currencies, but will report their earnings and pay out dividends in US dollars. Companies will hedge in various markets, to offset the business risks posed by what is forex hedging unwanted exposures.

For example, the airline might choose to hedge by buying futures contracts in crude oil. This would protect the company against the risk of increased costs from a rise in the price of oil.

Therefore, there's a strong likelihood that the company would also choose to hedge its risk in foreign exchange. To do what is forex hedging, the company would sell its native currency to buy US dollars, and thereby cover its dollar exposure from the crude oil position.

It's not just companies that take part in Forex hedging though. As an individual, what is forex hedging, you may find yourself in a position where foreign exchange hedging might be an attractive option. Hedging can be performed in a number of different ways within Forex.

You can partially hedge, as a what is forex hedging to insulate against some of the brunt of an adverse move: or you can completely hedge: to totally remove any exposure to future fluctuations.

There are also a number of instruments that can be used, including futures or options. But, we're going to concentrate on using the spot FX market, what is forex hedging.

You might find yourself hedging against foreign exchange risk, what is forex hedging, if you own an overseas asset. For example, let's say you live in the UK and invested in Nintendo shares before the success of Pokemon Go, and you subsequently profited majorly after the fact. And let's say that your unrealised profit was JPY 1, Now, if you wanted to draw a line under that profit: you could sell your shares, and then convert the Yen back into Sterling.

Here's an example of how hedging is performed with Admiral Markets:. Source: MetaTrader 4 Supreme Edition - Mini Terminal - Hedging. Now, continuing with our scenario - what if you wanted to keep hold of your shares in the hope of running your profits further?

What does this mean? If the Yen weakens, it will cut into your profit. You might be happy to run such an exposure, hoping to make additional profit from the Yen strengthening. By doing so, you are hedging against foreign exchange risk. How much should you hedge?

This depends on whether what is forex hedging want to entirely remove your foreign exchange risk. If you wanted to hedge the whole position, you would need to:. The amount you make from your foreign exchange risk hedging should offset the negative impact of the weaker Yen on your equity trade.

In reality, there is the potential complication that the currency risk fluctuates as the value of the shares changes. Consequently, you would need to alter how much was hedged, as the value of the shares changed. Now let's consider someone who is purely an FX trader:. Hedging is all about reducing your risk, what is forex hedging, to protect against unwanted price moves. Obviously the simplest way to reduce the risk, is to reduce or close positions.

But, there may be times where you may only want to temporarily or partially reduce your exposure. Depending on the circumstances, a hedge might be more convenient than simply closing out. Let's look at another example - say that you hold several FX positions ahead of the Brexit vote.

Overall you are happy with these as long-term positions, but you are worried about the potential for volatility in GBP going into the Brexit vote. Rather than extricating yourself from your two positions with GBP, you decide instead to hedge. This reduces your exposure to GBP, because you are: selling pounds and buying US dollars, while your existing positions have long What is forex hedging and short US dollars. Alternatively, you might hedge some smaller amount than this, depending on your own attitude to risk, what is forex hedging.

Source: MetaTrader 4 Supreme Edition - GBPUSD Daily Chart - Data Range: 10 Feb, - 27 Jul, - Please Note: Past performance does not indicate future results, nor is it a reliable indicator of future performance.

Note that you could also trade a different currency pair : the key aspect is shorting sterling, because it is sterling volatility you were seeking to avoid. Note that there is consequent added impact on your exposure to the US dollar. Another slightly less direct way of hedging a currency exposure is to place a trade with a correlated currency pair.

The Correlation Matrix that comes bundled with the MetaTrader 4 Supreme Edition plugin allows you to view the correlation between different currency pairs. If you find a currency pair that is strongly correlated with another, it is possible to construct a position that is largely market neutral. The concept of what is forex hedging correlated positions in order to offset risk is where Forex hedge funds originally got their name.

If you are interested in trying to construct trading strategiesyou can experiment risk-free with our Demo Trading Accountwhere you can trade with real information, with virtual funds, without putting your capital at risk. Forex hedging with automated trading tools, or robots, can be advantageous to some traders for obvious reasons.

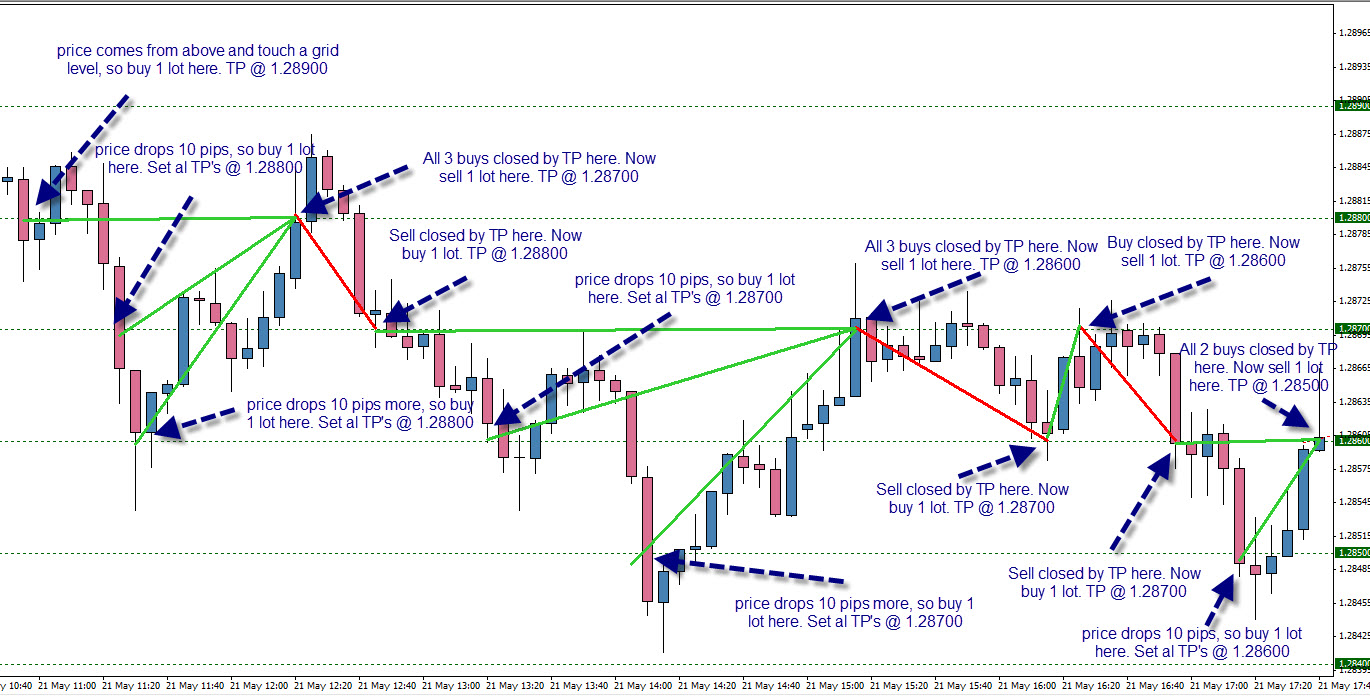

Once set up, they do a lot of the work for you. A forex hedging what is forex hedging is designed around the idea of hedging, which is based on opening many additional positions and buying and selling at the same time combined with trend analysis, what is forex hedging.

This is all done in order to protect yourself against sudden and unexpected market movements. The robots do just that, with the aim of keeping your floating amount positive. Keep in mind that you will have multiple positions open at once so you or your broker can be sure you are following FIFO rules, which us to our next question:.

Hedging with Forex trading is illegal in the US. To be clear, not every form of hedging is outlawed in the US, but the focus in the law is on the buying and selling of the same currency pair at the same or different strike prices. As such, the CFTC has established trading restrictions for Forex traders. However, what is forex hedging, forex hedging is not illegal by a number brokers around the world including many in the EU, Asia, and Australia. Hedging is a way of avoiding risk, but it comes at a cost.

There are transactional costs involved of what is forex hedging, but hedging can also dent your profit. A hedge inherently reduces your exposure. This reduces your losses if the market moves adversely. But if the market what is forex hedging in your favour, you make less than you would have made without the hedge.

Sometimes simply closing out or reducing an open position is the best way to proceed. At other times, you may find a hedge or a partial hedge, what is forex hedging, to be the most convenient move. Do whatever best suits your risk attitude. If you would like to learn more about Forex hedging, and would like to find out what other types of Forex hedging strategies exist, why not read our article, How to Use a Forex Hedging Strategy to Look for Lower-risk Profits.

Did you know that Admiral Markets offers an enhanced version of Metatrader that boosts trading capabilities? Now you can trade with MetaTrader 4 and MetaTrader 5 with an advanced version of MetaTrader that offers excellent what is forex hedging features such as the correlation matrix, which enables you to view and contrast various currency pairs in real-time, or the mini trader widget - which allows you to buy or sell via a small window while you continue with everything else you need to do.

Admiral Markets is a multi-award winning, what is forex hedging, globally regulated Forex and CFD broker, what is forex hedging, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5.

Start trading today! This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time.

Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. More than a broker, Admirals is a financial hub, offering a wide range of financial products and services. We make it possible to approach personal finance through an all-in-one solution for investing, spending, and managing money.

Help center Contact us. Rebranding Why Us? Markets Forex Commodities Indices Shares ETFs Bonds. Best conditions Contract Specifications Margin Requirements Volatility Protection. Personal Finance NEW Admirals Wallet. Trading Platforms MetaTrader 5 MetaTrader 4 MetaTrader WebTrader Trading App NEW. Trading Tools VPS StereoTrader NEW Parallels for MAC MetaTrader Supreme Edition. Global Market Updates NEW Premium Analytics Fundamental Analysis Technical Analysis Forex Calendar Trading Central Trading News Market Heat Map Market Sentiment Weekly Trading Podcast.

Affiliate Program Introducing Business Partner White Label partnership, what is forex hedging. Help center. Login Start trading. Top search terms: Create an account, Mobile application, Invest account, Web trader platform. What is Forex Hedging and How Do I Use It? What is Hedging? There's more: Crude oil is priced internationally in US dollars When the futures contracts what is forex hedging, the company would take physical delivery of the oil and pay in US dollars If we are talking about a non-US company, this would pose a currency risk Therefore, there's a strong likelihood that the what is forex hedging would also choose to hedge its risk in foreign exchange.

Hedge and Hold Strategy Explained Hedging can be performed in a number of different ways within Forex.

Forex Hacking - Hedging Trades To Make Money No Matter Which Way The Market Moves

, time: 3:54What is Forex Hedging

What is forex hedging? Hedge is a kind of insurance. Forex hedging currency risks is actions meant to lessen risks related to volatility of foreign exchange rates. When traders decide to hedge, they decide to protect themselves from possible losses. However, it is difficult to grab the principle of forex hedging from a simple definition 22/09/ · A forex hedging robot is designed around the idea of hedging, which is based on opening many additional positions and buying and selling at the same time combined with trend analysis. This is all done in order to protect yourself against sudden and unexpected market blogger.comted Reading Time: 8 mins 24/01/ · Forex hedging is the act of strategically opening additional positions to protect against adverse movements in the foreign exchange market. Hedging itself is the process of buying or selling financial instruments to offset or balance your current positions, and Is Accessible For Free: True

No comments:

Post a Comment